Three ways to reconcile business performance and impact

- Business model innovation of main concern to companies, many of which are questioning the impact of their activities.

- However, the notion of impact remains vague and there are no tools to evaluate it as precisely as economic or financial performance.

- It is necessary to go beyond the concept of “sustainable business model” by ensuring that the impact of the company as a whole is taken into account.

- Accusations of “greenwashing” or “impact-washing” stem from the non-alignment between value creation and value communication within the business model.

- The role of stakeholders (institutions, funders, academia...) in delivering impact is fundamental.

Innovating in business models to survive disruptions is at the heart of companies’ concerns. But this issue has traditionally been linked to objectives of sustainability, development, and performance – essentially financial – of the company. However, driven by major climate change, as well as by the “quest for meaning” affecting young people and a growing part of society, more and more companies are questioning not only the economic but also the environmental and social impact of their activities.

Companies have precise means to measure their economic and financial performance, but the very notion of impact, as well as the necessary tools that stem from it, remain vague and incomplete. Even the most advanced companies on these issues are still lacking the means to reconcile their necessary performance with the increasingly pressing imperatives of impact.

#1 Going beyond the concept of the “sustainable business model”

Caught between two seemingly contradictory injunctions – business performance and impact – companies are looking for new keys to reading and making decisions. In response to this need, many attempts have been made to define what a sustainable business model is; in particular by means of archetypal virtuous business models that companies seeking to make an impact (by choice or by obligation) should follow.

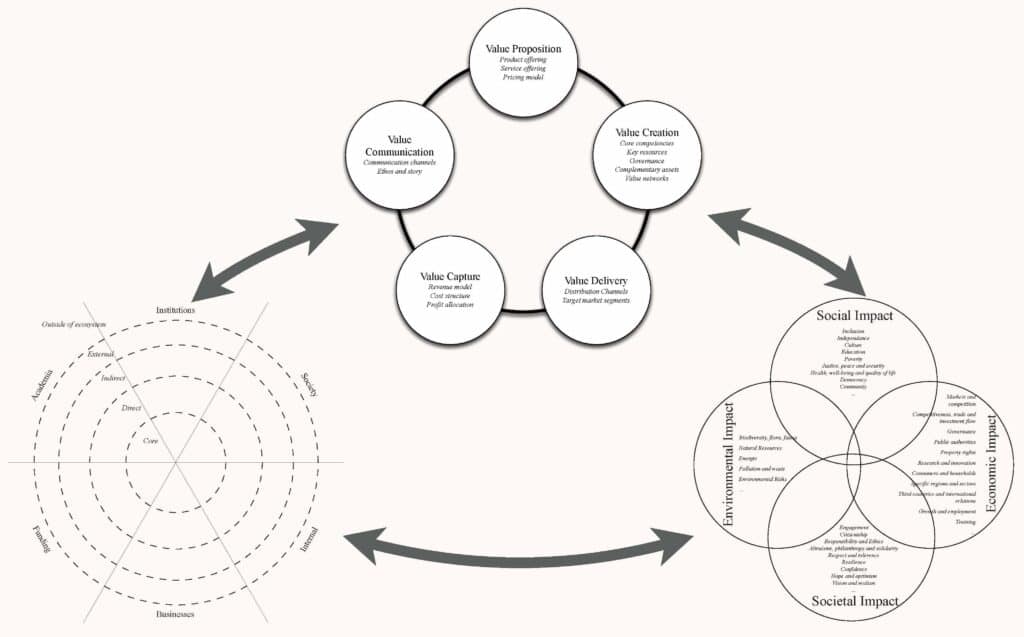

While these models, or “canvases”, have the advantage of making companies and their managers aware of these issues, they have the disadvantage of mixing two essentially distinct questions: the what (or why), i.e. the impact, and the how, i.e. the business model. In strategy, confusing the ends with the means is rarely a good idea! This is why it is essential to use separate tools, one allowing a diagnosis and a detailed understanding of the business models, the other allowing an extensive and holistic understanding of the resulting impact.

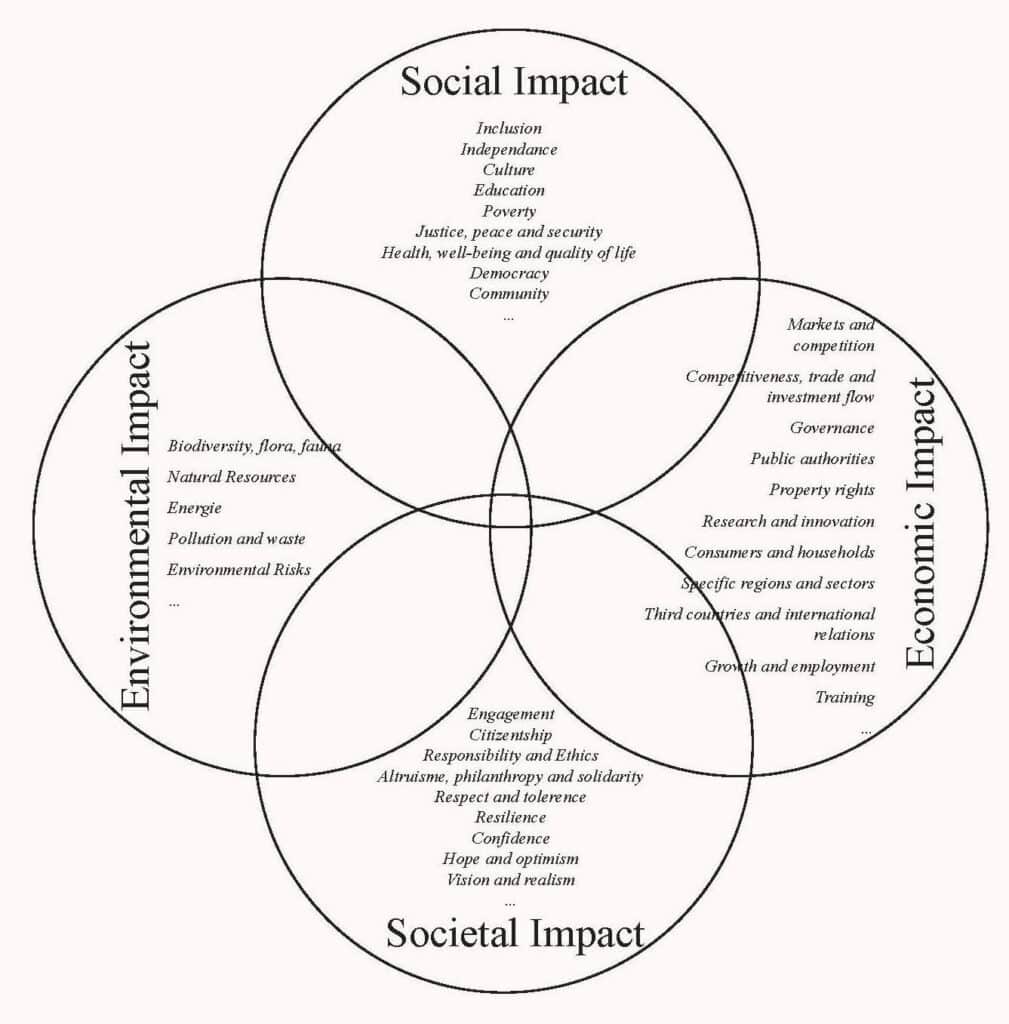

However, the study we conducted1 shows that impact is only partially considered: only environmental and sometimes social aspects are taken into account by companies in their evaluations, even those that are most advanced in this area. This has a negative influence on the definition of their strategies and the reflection on the evolution of their business model.

This bias stems from a quantitative bias: it is much easier to evaluate what you can measure. This pushes companies, even the most attentive to these issues, to focus on environmental and quantifiable dimensions (typically CO2emissions), leaving aside environmental, but especially social dimensions, which although observable, are by nature difficult to measure (e.g. biodiversity, resilience). This bias is reinforced by existing impact measurement tools, which are themselves partial and biased, and by regulations and public policies, which tend to push companies to take into account only certain aspects of impact, and only partially.

Our study illustrates the risk of combined metrics (which aim to arrive at an overall impact score or index) that oversimplify an essentially complex phenomenon and hide the necessary trade-offs between the dimensions of impact: impact in one dimension (e.g. environmental) is often at the expense of other dimensions (social or economic). The impact must be taken into account in its entirety (environmental and social dimensions, obviously, but also economic and societal dimensions2) in order to make informed decisions.

#2 Aligning impact and business model to avoid greenwashing

Our study reveals a widespread fear among companies of accusations of greenwashing or impact-washing. However, our analysis of the CSR policies of major companies highlights the source of these accusations: very often, their CSR actions are largely disconnected from the core of their business model and their value creation. In the end, they only serve as a means of communication, without fundamentally changing the nature and scope of the impact of these companies: planting trees (a popular CSR action these days) is not part of the value creation of companies, unless they are horticultural companies!

Companies’ impact strategies are often only concerned with one particular aspect of their business model, namely value communication, leaving aside the other dimensions of the business model (value proposition, value creation, value dissemination, value capture). Sometimes these companies create an impact product or service – typically a green (e.g. eco-refills, solid shampoos) or ethical product – that is sold at a higher price (and margin) to more affluent consumers, but which does not, despite being communicated as such, result in a significant impact.

This non-alignment between impact and business model leads to accusations of green/impact-washing. When impact is embedded in all the components of the business model, communication about impact becomes intrinsically credible. It is then less necessary for the company to communicate about impact: the communication is self-created.

Another conclusion: “making an impact” does not consist so much in doing “new things” – launching “impact” products or services – but in doing “the same things” differently, by transforming the business model so that it is, for a given product or service, truly impactful in all its dimensions.

#3 Engage internal and external ecosystems

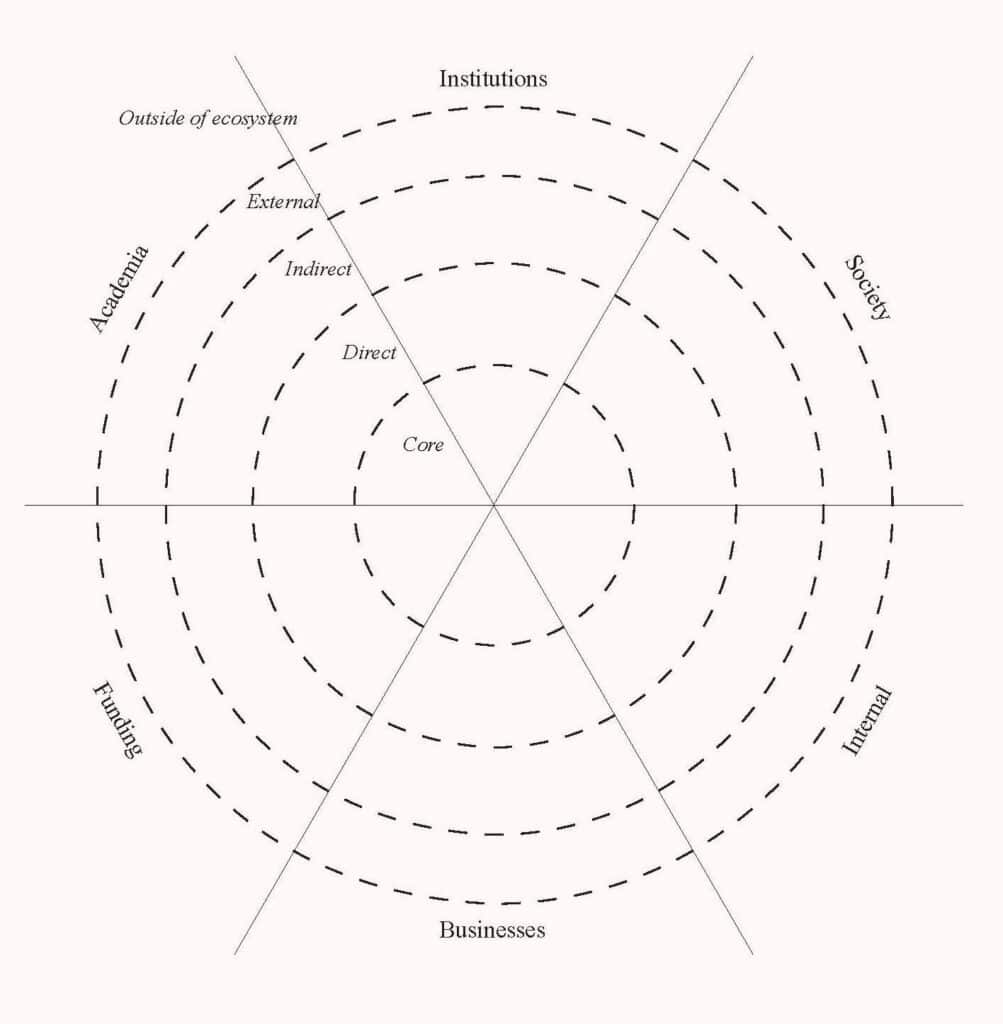

Our study shows the critical role of ecosystems (value networks) in the ability of any company, however large, to deliver impact. Large and lasting impact does not happen alone, even for the largest companies. The role of internal and external stakeholders (companies, institutions, funders, academics, society) in delivering impact is crucial. Mobilising existing stakeholders and attracting new ones is fundamental.

But this requires a detailed and comprehensive understanding of the company’s ecosystem, because even if the company finds the ‘perfect’ business model, its implementation can backfire if it does not mobilise the stakeholders needed to achieve it and alienates key partners.

Finally, our study shows the fundamental role of governance in delivering impact, both in terms of business model innovation and ecosystem mobilisation. Whether it is with regard to the company’s internal or external stakeholders, the management of its resources, etc., it is necessary to rethink the modes and forms of corporate governance: it is a key ingredient in reconciling the company’s performance with the impact it wishes to achieve.

A methodology for reconciling performance and impact

Our study led to the implementation of a methodology to rethink corporate strategy to reconcile performance and impact. Combining three distinct tools – business model diagnosis, ecosystem mapping, impact assessment – it enables the company to understand each aspect of this complex problem in detail. Each tool is a key to entry into the reflection. Depending on the context, companies and their teams may need to think about and diagnose one of these three aspects first – the business model or ecosystems or impact – before considering how the other two dimensions affect this primary objective.

To conclude, is it possible to reconcile business performance and impact? We are convinced that the answer is yes. But this requires a different, broader view of what performance and impact are. In particular, it requires companies to adopt decision-making tools that allow them to understand in detail their capacity to create value and impact in relation to their ecosystem.