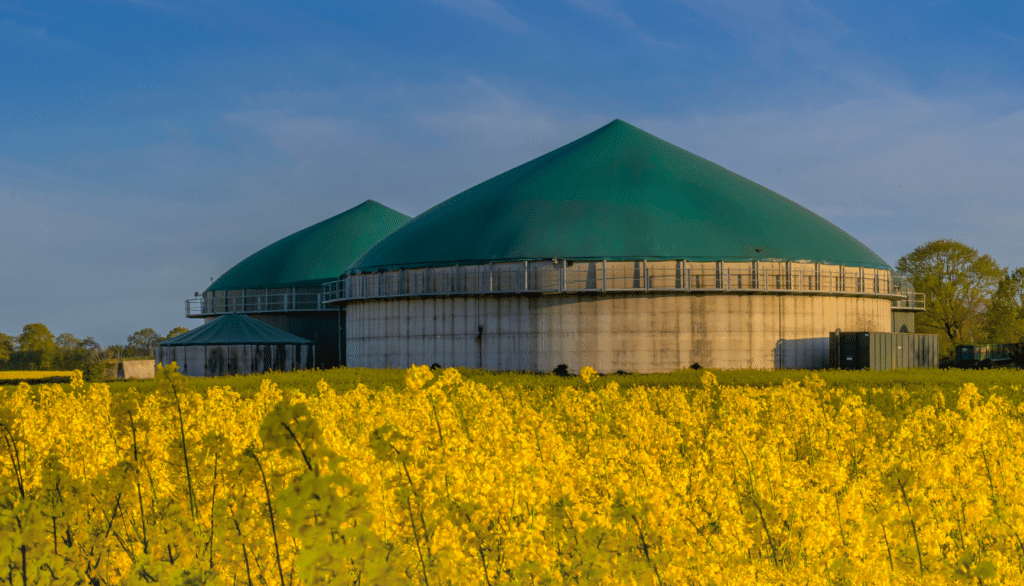

Methanisation, also called anaerobic digestion, is a natural biological process whereby material is broken down by micro-organisms. In doing so, it releases energy from organic matter. Industrial methanisation is the exploitation of this process, often in agricultural settings, as sustainable source of energy. Whilst methanisation is still growing in usage, there remain several unexploited solutions to be explored, which could further improve its environmental performance1.

Purifying biogenic CO2 to reduce methane emissions

The biogas produced by methanisation generally contains 50–70% methane (CH4) and around 30–50% CO2. During the process that produces the biomethane, CO2 is separated from the gas to deliver a flow with high methane concentration. In this practice of biogas purification, off-gases are emitted to the atmosphere. They mainly contain 98% CO2 and 1–2% residual methane2. According to the industry, this CO2, called biogenic CO2, does not contribute to a net addition of climate gases.

Nevertheless, the residual methane released into the atmosphere does contribute to global warming. Therefore, to reduce the environmental impact of the plants in France, a new regulation has been issued. It requires biogas-to-biomethane plants to limit their emission of methane in the off-gases to 0.5–1% by 20253.

To abide by the new regulation, mature technologies (such as cryo-distillation, absorption by solvent, pressure swing adsorption) are available and allow the separation of biogenic CO2 from the residual methane. Purifying the biogenic CO2 would allow plants to meet objectives and enhance the performance of the plant by reinjecting the residual CH4into the grid. Also, an additional virtuous loop takes place. Indeed, the purified biogenic CO2 can be used to create value through multiple outlets.

Circular thinking could create novel synergies in the French market

Using CO2 in specific settings can contribute to the circular economy4. The CO2 can be injected into greenhouses or applied directly to crops. It can also be used in various industrial applications, such as in the production of plastics, chemicals, and building materials like concrete. CO2 can also be used for other purposes, such as in the food and beverage industry for carbonation, in the medical industry for imaging, and in firefighting as a dry ice substitute. E‑fuels and microalgae are other potential outlets that are also being investigated.

Therefore, capturing the biogenic CO2 that is otherwise emitted into the atmosphere could create novel synergies between biomethane plants and CO2 users and thus provide a sustainable alternative to fossil-based CO2 in products. There are seasonal tensions on the CO2 market, inducing price volatility associated with shortages that can greatly affect some consumers. In fact, the market price of CO2 is highly variable: approximately €50 to €200/t5. Thus, having local biogenic CO2 produced by french biomethane plants would make it possible to meet these current challenges.

France is home to Europe’s fastest-growing biomethane sector6. The number of units producing biomethane was a little over 500 at the end of 2022 in France7. There is a growing interest in finding ways to further improve sustainability of these plants. Purifying biogenic CO2 would help meet the environmental guidelines in 2025 and substitute fossil-based CO2 use in France. In France, 800 Kt/year of CO2, are consumed, of which 70% by the agri-food industry8. The potential of biogenic CO2 that can be valorised through these plants has been estimated at around 700 to 800 Kt CO2/y. To date in France, less than a dozen biomethane plants have implemented this circular activity9,10.

Co-creating a circular business model is no simple task

While the potential benefits of CO2 valorisation in biomethane plants are significant and promote the development of a circular economy, there are still technical and economic challenges to overcome in France. Depending on the outlet chosen and the recovery technology of CO2, the process will impact the overall energy efficiency of the biomethane chain and the cost of CO2 capture. Also, the biggest user of CO2 in France remains the agri-food sector. Specific quality certifications, such as the EIGA standard, are needed for biogenic CO2 to be compliant with this industry. Furthermore, in France, biomethane units have an average production capacity of 1.8–2 kt CO2/year, whereas conventional sources of CO2 can supply up to 200 kt CO2/year. Hence, mutualization is needed in biogenic CO2 transportation to enhance economies of scale11.

Over the past years, the implementation of a favourable regulatory framework has supported the expansion of the French biomethane sector. Case in point, the regulation to reduce CH4 in off gases will help improve its environmental impact. Additionally, it might create a potential market for biogenic CO2 that could substitute the fossil-based one. Nevertheless, if the process would make sense environmentally, the business model is still to be created. Efforts are required to co-create a viable value proposition. Surely enough, the local demand side is yet to be stimulated. Efforts from industrial players can be pursued to propose biogenic CO2 at a competitive cost while improving logistics and cost capture technologies. Other levers can be identified, such as implementing a regulatory incentive for the producers and for the consumers of biogenic CO2. However, the latter can be a double-edged sword because it can deter the reduction of conventional CO2 by implying there is a need from the demand side. Lastly, industrial players are investigating novel financial valuation, such as the selling of carbon credits associated with the sequestration of the biogenic CO2 on the long term, through specific products12.