Since the Bitcoin network started in January 2009, the tokens issued by the network (the “bitcoins”), have grown in value: from $0 at the beginning, each bitcoin is now worth $43,144 (on 21st September 2021). Many other crypto-currencies have followed Bitcoin, but it is still the largest with a capitalisation of $800bn, representing about 44% of the capitalisation of all crypto-currencies, of which there are now more than ten thousand. The value of a bitcoin is extremely volatile and there is no guarantee that it will continue to rise; some economists, such as Nobel Prize Economist Jean Tirole, consider it to be a bubble that will burst1.

Jean-Paul Delahaye, mathematician and professor of computer science has been watching closely as cryptocurrencies exploded over the last decade. For him, the energy consumption of the Bitcoin network is enormous and absurd because it corresponds to an initial design error in the network’s operating protocol, for which solutions have now been found and implemented by other crypto-currencies. It is only unhealthy speculation in Bitcoin that keeps the price high.

You are an expert on Bitcoin, can you give us a quick 1.01 of how it works?

Jean-Paul Delahaye. The release and circulation of bitcoins is operated by a network of computers that works without a central authority (peer-to-peer network). This network was conceived by one or more people acting under the name of Satoshi Nakamoto, whose identity is still unknown. Each computer in the network holds a copy of a file called the “blockchain” which contains all the information about the contents of bitcoin accounts and the movement of bitcoins from one account to another.

To encourage new computers to participate in this management of the Bitcoin currency, an incentive is distributed every 10 minutes to one of the computers on the network by creating a few more bitcoins ex-nihilo. This reward – that was 50 bitcoins at first, then 25, then 12.5, and now 6.25 – is awarded to the winner of a calculation contest. This is known as “mining”, and it is this computational contest, called proof of work, which involves a significant expenditure of electricity. The computers that try to win the prize are called Bitcoin miners; a prize that is equivalent to around $270,000 (on 21st September 2021).

This power consumption is problematic for two reasons. It has become enormous over time, and it is unnecessary because there are other methods of awarding the incentive, such as proof of stake, which do not involve massive use of electricity.

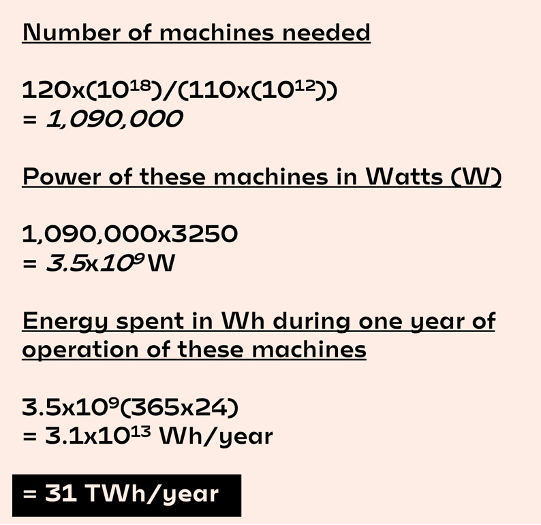

How much do you estimate to be the energy consumption of the Bitcoin network now? We can know the cumulative power of all miners with good accuracy because the average time between two pages (or block) depends on it2. As of 18th August 2021, this total is around 120x1018 hashes per second (1 hash = 1 calculation of the SHA256 function3). Today, the best machine for calculating hashes is the Antminer S19 Pro, which calculates 110 TeraHash per second with an electrical power of 3,250 W4. If we assume that all Bitcoin miners use this tool (which is of course very optimistic, as there are still a lot of mining tools in use that use more electricity per hash), a simple computation can tell us how many TWh/year the Bitcoin network uses:

This minimum is compatible with estimates by digiconomist (34 TWh/year)5 and Cambridge Bitcoin Energy Consumption Index (31.7 TWh/year)6. It cannot be less, and those who dispute this result are not serious. Therefore, each year Bitcoin uses (at least) as much electricity as four nuclear reactors produce per year, and (at least) as much as all the wind turbines in France. This is not a hypothesis; it is a certainty!

For an even more pessimistic outlook, we should consider the use of older, less efficient mining machines, the cooling required in the Bitcoin mining factories and the energy used to produce the machines. All of which mean that we should double or even triple the minimum estimate!

China recently banned Bitcoin mining. Why did they do this? What impact will this have?

Until recently, Bitcoin mining was concentrated in China, with as much of 60% of mining factories being found there. However, the Chinese government has now banned mining almost entirely. There are several explanations for this, one of which being that China does not want its citizens or businesses to use cryptocurrencies to prevent competition with the Yuan and avoid money laundering etc. But also, China wishes to reduce its CO2 emissions and the cheap electricity required for Bitcoin is risky in that respect. Today the energy spent on mining Bitcoin is not green at all. Miners have no particular interest in it. What matters to them is to pay the cheapest possible kWh – they don’t care if it the energy is renewable.

As such, mines have been pushed to move to other countries where the electricity prices are low enough to remain profitable. In France or Germany, for example, electricity prices are too high at ~$0.15-$0.20 per kWh. Whereas in USA or Canada it is much cheaper reaching as low as $0.03–0.05 per kWh, in some cases. In the USA, Canada and Iceland, there is the possibility to buy cheap electricity from hydroelectric dams. Hence, Bitcoin mining factories are often built close by. When the Bitcoin price rises, it can even have the effect of reopening old coal-fired power stations!7

It is important to understand that the more the Bitcoin price increases, the more electricity miners are willing to pay for electricity to mine, so if the Bitcoin price were to increase by a factor of 20 (which is a minimum for there to be enough money in Bitcoins to compete with the dollar or the euro) then the electricity for the Bitcoin network would also (eventually) increase by a factor of 20. There will never be more than 21 million Bitcoins (that is a limit written into the base protocol), so the value available in Bitcoins can only increase if its price increases. I don’t think it’s conceivable that the power consumption of Bitcoin could be multiplied by 20, without strong pushback and regulation from governments. Moreover, if the demand of miners was multiplied by 20, this would have an enormous effect on the price of electricity which would increase for everyone, which would just not be acceptable. Rather, I think that little by little crypto-currencies using better protocols will take over, and in fact they already have. The relative importance of Bitcoin is decreasing, from 68.2% a year ago to 44% today. Even the speculators who hold Bitcoin are gradually realising that it is doomed in the medium-term and that they should bet elsewhere!