Intensive farming uses more and more plastic. On the one hand, this helps reduce environmental impact, as it means less water consumption and more protection for crops. But what happens to these plastics after they are used? Recent shifts in this area involve a rise in the use of biodegradable films as a solution.

Global agriculture uses 6.12 million tons of plastics annually; only a fraction of total plastic production. The agricultural industry in France, for example, uses around 105,000 tons of plastic every year, which is less than 2% of national consumption. The figures are similar in other developed countries.

Nevertheless, this 2% requires particular attention.

First of all, for their impact: these films are primarily used to protect crops in greenhouses, as anti-hail protective netting, ground protection for vegetable farming or tarpaulins for feed packaging. In doing so, they help to reduce water consumption and pesticide use, contributing to an overall lower environmental footprint.

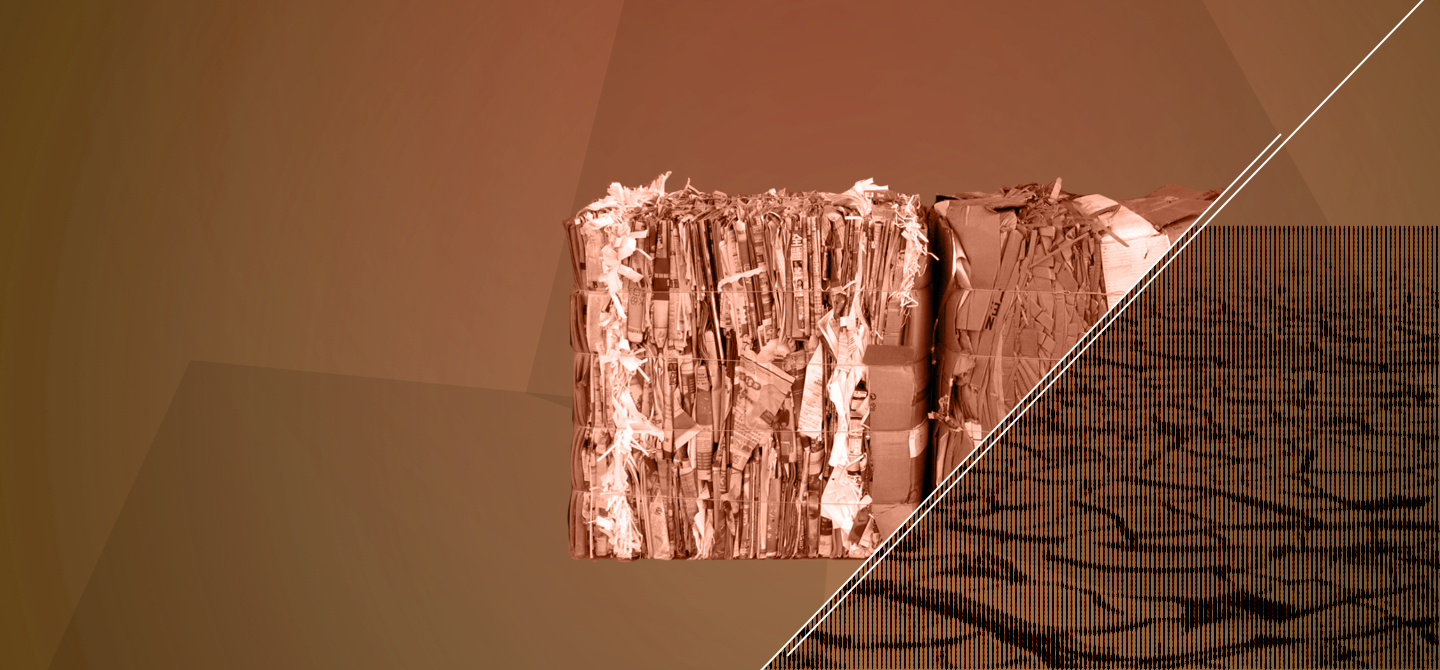

Second, because of what happens to them after being used. In Europe and the United States, there are recycling channels for agricultural plastics. Historically, however, most of these products have been shipped to China, which meant that when China suddenly stopped importing waste for recycling in 2018, it blocked up the plastic recycling channel in the short and medium term 1. What’s more, recycling is actually not the best option for films that are used on farms. They often get dirty and therefore weigh more, making them more expensive to recycle and still pieces of plastic are often left behind in the fields. Not to mention that recycling is virtually non-existent in many countries.

As such, degradable films, which are left to break down in fields after being used, were developed. But whether this process is truly environmentally-friendly has been a topic of great debate in Europe and the United States for the past ten years 2.

Oxo-degradable or biodegradable?

For many years, the industry has focused on “oxo-degradable plastics,” a sector led by UK-based Symphony Environmental and Brazilian company Tekplast.

These plastics are made from polyethylene with a catalyst to stimulate breakdown – iron, manganese or cobalt sulphate. When exposed to UV rays, heat, and oxygen in the air, the long chains of polyethylene break and oxidise, turning into smaller molecules; a process that takes between 2–24 months. Manufacturers assert that 90% of these microplastics are then absorbed by microorganisms that live in the soil. However, environmentalists as well as European Bioplastics, the lobby for bioplastics manufacturers, are concerned about the remaining 10% and the pollution caused by these microplastics, which do not break down even in industrial compost facilities. In 2018, the European Commission was persuaded by their arguments 3.

With an EU ban on oxo-biodegradable plastics scheduled for 2021, biodegradable films are a favourable alternative. This up-and-coming sector is led by Italian company Novamont.

When a product biodegrades, it does not simply break up under chemical processes; rather, it is digested by microorganisms. The composition of biodegradable agricultural plastics differs greatly, and they are made using specialised technology. No less than 50 patents protect Novamont’s flagship product, Mater-Bi.

161,000 tons of biodegradable plastics are produced for agriculture worldwide annually, five times less than equivalent products in the food packaging industry 4. Currently, this is a niche within a niche. But growth of this emerging industry is driven by pressure from the recycling industry and elevated EU standards. It is now a European speciality, supported by the consortium Agrobiofilm 5. As the number-one global producer by volume, China is following developments closely, with leader Pujing Chemical Industry Co. supporting the work of European manufacturers.